It is very common for businesses – both start-up and small, established – to seek investors to provide capital. External investments are often sought after because securing business loans from banks can be a tedious and challenging process. Venture capital funding is a series of large investments and typically the hardest to achieve. But don’t get discouraged, your business may qualify for venture capital investing and it could be a great source to take your company to new heights. If you are considering seeking venture capital investments, here are 7 tips to do your due diligence and ultimately snag your next big backing. 1.Know the difference and decide if VC is right for your business. There are many investment options, and the titles of each can get confusing. Angel investments and funding from family and/or friends are separate from venture capital funding. VC equates to large sums of funding dispersed over a specific period, and the return on investment is important! Make sure to do your research before jumping into the process. The process can be long – it can take several months from initial inception to completion, so you want to confirm this is the right process for your business goals. 2.Do your research to find the right firms. Clarify the types of investors you’re looking to for support and ensure they have a track record of investing in similar companies as yours. Identify a series of firms that catch your eye and, you guessed it, do even more research on them. You want to have a strong understanding of who you will potentially be working with, because there’s a possibility you will be sharing ownership of the company and working closely with the firm. 3.Get their attention. Stand out from the next company who is also seeking investment. Treat each investor you seek out like a relationship and treat them with uniqueness. Try to avoid using template formats for the documents you share with them, and make sure what you prepare looks like you prepared it specifically for that firm – never send bulk emails or materials! 4.Work your connections. VC investments are similar to any career – in addition to what you know, it’s who you know. Use several platforms such as LinkedIn to identify any connections you may have with the firms you are seeking out. Getting a personal introduction is not only flattering for yourself and business, but also a great way to get your foot in the door. Again, treat your connections with uniqueness and approach each firm one at a time (people know people, and people talk!) 5.Have your marketing materials ready. When the time is right, make sure you’re ready. Have formalized documents prepared, as well as an awesome tag line for you to sell yourself. You will want to have an investor focused slide presentation and a business plan summary, at a minimum. 6.Sell yourself – prepare an amazing pitch. Speaking of selling yourself, having a well-thought-out pitch and talking points prepared is vital, because you never know when your next impromptu conversation with a potential investor may be (unless you’ve scheduled meetings ahead, of course.) A website or digital version of your pitch is also a nice touch in today’s digital age. 7.Stay patient during the process. Again, the process to secure venture capital funding can be long and daunting from inception to completion. But keep your spirits high and your patience even higher. Once you secure your funding, the real fun of begins…..working with your new investors to make your business take off! Are you looking to secure your next investment for your next big idea? Stop by our website and see how we can help.

3 Comments

Imagine what could happen if a business’ most sensitive information was lost, or worse, carried to a competitor. Unfortunately, this is a reality as more than 53 percent of businesses who don’t have well-established processes and systems for monitoring access to applications and data sources that people used on the job, according to a report from Osterman Research. One Valley Growth Venture portfolio company, DAtAnchor, has a solution to this problem.

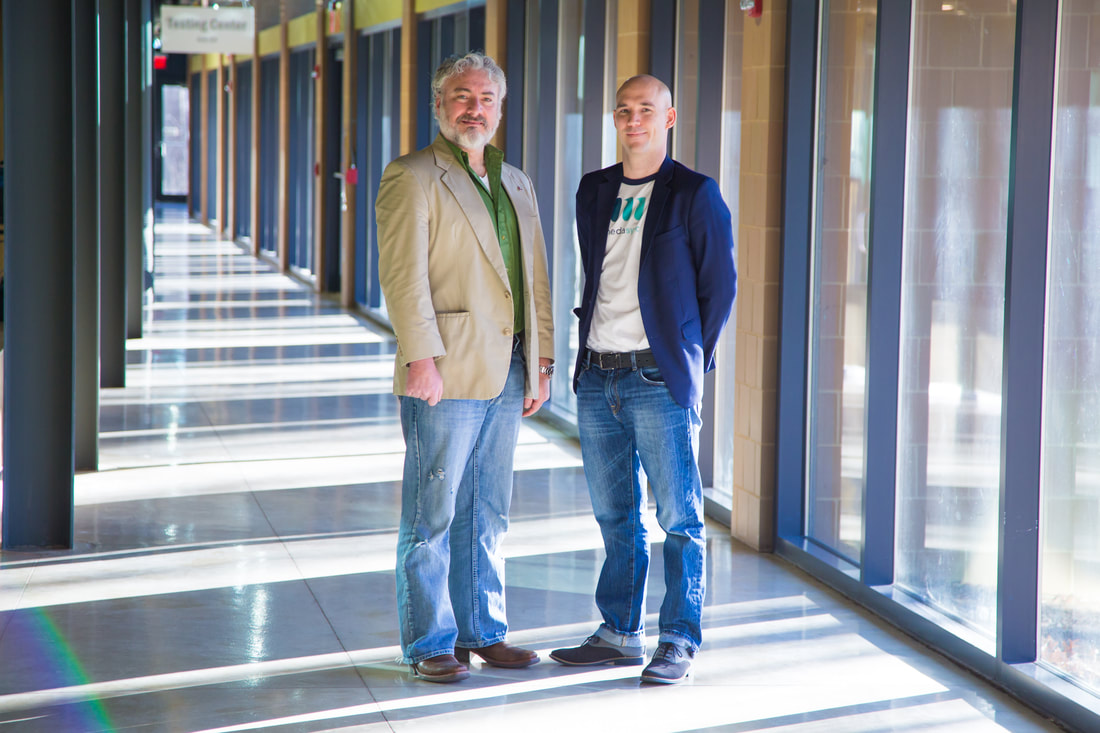

DAtAnchor is a data control and security solution, which provides seamless and easy-to-use strong encryption, automated data governance, and dynamic access control and revocation capabilities, enabling businesses to protect their sensitive data. DAtAnchor is a universal solution, protecting all data types, along with any application used to secure it. It is very easy to set up and seamlessly integrates with any existing cloud-based security solution or distributed storage system. Additionally, DAtAnchor’s data control SDK can be easily built into custom applications and cloud-based platforms. In other words –DAtAnchor prevents former staff, partners and even hackers from accessing secured information outside of the scope of a business, which according to the company’s Head of Product Eric Flecher, is a serious problem.“On average, 60 percent of employees bring data from their former employer to their next place of employment,” Flecher said. After spending years as a software consultant, Flecher realized he had a knack for problem solving and noticing blind spots within businesses, which led to him joining a young organization[EK1] . “I’ve always loved the idea of startups. Startups allow you to solve real problems in the world quickly.” The effect of unsecured data & information The long-term cost of unsecured business information has a significant impact. This could lead to trade secrets falling into the hands of competitors, to exposure of personal data that is illegal to disclose, to putting compliance with regulations governing data privacy at risk. “While traditional data protection has included companies attempting to create walls to protect their confidential data, DAtAnchor, actually controls data so that it’s not usable outside of a particular business defined boundary,” Flecher said. Valley Growth Ventures chatted with Flecher to discuss the new startup’s journey to joining the VGV team and their future plans. VGV: What is the current status of your business? Flecher: “As a business in our seed round, we are working to identify which market is best suited for our product. Customer feedback is critically important for us at this stage. We are currently conducting experiments in the form of MVPs to learn which use cases and feature configurations work for our customers and DAtAnchor as a viable product.” VGV: What is your professional background? Flecher:“I spent 15 years in software and have always been a consultant. I started to learn that I really enjoyed building software for companies. I found that I enjoyed problem solving, engineering and developing user experiences.” VGV: What are some successes DAtAnchor has experienced? Flecher:“We have quickly enrolled 20 companies in our POC programs. These companies have helped us gain valuable market feedback. Within these POC programs, we have gained many DAtAnchor advocates. These individuals have helped us identify new use-cases and promote internally.” VGV: Can you offer words of wisdom for other aspiring, or beginner entrepreneurs? Flecher: “You have to be willing and open for unexpected change, and have the insight to check your ego at the door constantly. It is ok be wrong, at times, and consistently ask yourself if you’re making the right decision. Oh, and don’t take yourself too seriously, either.” Are you a company who may need DAtAnchor’s services? Head over to their website and learn more about you can protect your business.  Caring For A Growing Population By 2030 America will need 2.3 million more long-care workers to address the silver tsunami, a growing population of 19 million adults ages 65 and up, according to a recent study. However, while the need for services provided by skilled nursing facilities is projected to increase steadily, unstable reimbursement models and changes from healthcare reforms have created a perfect storm of factors that could significantly impact the operations of these facilities. This dilemma led Ryan Edgerly, CEO and Co-Founder, and Gene Groys, Co-Founder and Chief Strategy Officer, to develop healthcare software MedaSync. Founded in 2017, MedaSync is a software platform that provides predictive financial intelligence and decision support services in the post-acute care facility sector of the healthcare industry with a specific focus on skilled nursing facilities. “Healthcare reform created a lot of chaos in the marketplace and anytime you see that you know there are opportunities for solutions,” Edgerly said. The journey from idea to startup Edgerly and Groys both have extensive professional experience in the market space, with both a previous successful startup and a network of potential customers and partners. In fact, it was Edgerly’s work in tech for senior healthcare where he witnessed firsthand the changes occurring in the industry, and applied his knowledge to drive a savvy tech solution. While he noticed a void in the industry—he notes, developing a startup from the ground up is no easy feat. “It’s not an easy journey at all. You’re trading off the value of what you’re working on versus other life experiences. For me, it was interesting with a family and walking away from a really good sales job. Personally, I had to weigh the implications of that and how much would we have to sacrifice. From a business standpoint—you’re it. You have to set the pace, put in the hours and drive the business. No one will care as much as you do,” he said. VGV offers a lending hand While the entrepreneurial journey may have its fair share of challenges, Valley Growth Ventures has been a driving force for the startup, providing more than $350K investment in seed capital to support growth and offset operational costs. Additionally, VGV’s leadership and network support has proven to be significantly beneficial to MedaSync as well. “When you’re at risk trying to develop an idea, it’s very unscripted and there are a lot of places you can turn to for support. For us, it was important to find the right partners. We have been getting past some good milestones. And, it is the advice and guidance from our partners and investors that has kept us on the right path,” Edgerly said. Looking ahead: growth and expansion Over the next several years, the need for services provided by skilled nursing facilities is projected to grow along with the complexity in reimbursement models , which positions MedaSync at a position of growth as well. “We are in a very interesting point of time. There are going to be more people over 65 than ever before and the amount of change and inefficiency in the market offers a lot of problems to solve. We are excited to solve these problems so that our clients are able to take care of this population more efficiently.” |

Archives

March 2023

|